PC computers brought computing power into the home. Then the invention of the internet allowed anyone in the world to share information with anyone else in the world whose computer is connected to the internet. But what the internet did not allow was for you to secure ownership of any of that information. Before Bitcoin, all computer data, including money, was stored in a centralized computer database managed by another person or organization who had ultimate control over your digital property.

For example, I can send you a photo from my computer, but then I would have a copy of that photo and an infinite number of copies could be made by the person I sent it to. There was no way to send a digital item to someone else and ensure that they become the only person with access to it. Even your money that you consider safely stored at your bank, requires you to trust that bank. They are able to change the numbers in the computer that represent the amount of money you own. In other words, before Bitcoin, there was no way to guarantee that one person alone could control the supply and movement of a specific digital item.

Bitcoin solves Double Spend problem

The Internet decentralized the distribution of information, but it did not decentralize the distribution of value. Figuring out how to create digital scarcity was often referred to as trying to solve the “double spend problem”. If I send you money, we have to make sure not only that the receiver alone possesses that money, but also that the sender no longer has that money, and everyone on the network knows who owns what.

In 2009, Satoshi Nakamoto (anonymous developer name) released the Bitcoin White Paper (https://bitcoin.org/bitcoin.pdf) and began work on Bitcoin, a solution to the double spend problem. To the surprise of almost everyone, after a few years, we began to see that Bitcoin solved the double spend problem!

To make a very long story short, by including human greed into the algorithm, Bitcoin made it so that the only way to attack the network would be if you are able to control more than 50% of the thousands of computers that run the Bitcoin network. If you manage more than 50% of transactions in the Bitcoin network, why would you attack and destroy the value of the network in which you are the largest processor? Let's try to understand how this setup makes Bitcoin so resilient.

You can think of Bitcoin as a computer database that tracks which address owns how many bitcoins, but rather than store that information on one computer, it distributes the information publicly and simultaneously to each of thousands of connected computers (network nodes). If all nodes fail except for one, no data is lost, and the network can be rebuilt from there. Equally, if one computer’s database is attacked, the computer will just be recognized as not in sync and be kicked off the network without being able to manipulate the accuracy of the ledger.

Since there is not one central computer with control but thousands of decentralized computers working together, Bitcoin is also referred to as distributed ledger technology. The way Bitcoin works sounds strange at first, but turns out to be quite brilliant. All the computers on the network are competing to add the next block of transactions every ten minutes. They compete by trying to solve a computer math puzzle. The only way to solve the puzzle is to burn energy running your computer. Within ten minutes one computer on the network will solve the puzzle first. That computer is then allowed to add the transactions to the blockchain and share the puzzle’s answer with all other computers which will validate the answer. If the answer proves to be correct, the other computers also add the transaction to the blockchain database. Once the information has been stored across the network, it becomes immutable and is governed by the network’s rules.

The reason the computers are forced to do this puzzle solving (proof of work) is because if there was no work required or no money/energy required to add a transaction, it would be easy to spam the network with false entries. Hence, a functioning system guarantees that only truthful transactions can update the ledger.

The reason there are now 10,000+ computers (bitcoin miners) fighting to solve these puzzles and add the next block to the Bitcoin chain of transactions is because the winning computer is awarded some newly minted bitcoin in addition to generated transaction fees. This bitcoin reward covers the cost of the work performed to solve the puzzle. If the bitcoin reward does not cover the costs, then miners will drop off the network and Bitcoin automatically adjusts the puzzle to become easier to solve.

*Mining: Earning rewards for doing work is why processing transactions for Bitcoin are called “mining” transactions and transaction processors are called “miners”.

*Proof of Work: Getting all computers to agree to add a transaction to the network after doing the work to solve puzzles is called “Proof of Work”.

*Difficulty adjustments keep the puzzle solving work profitable for miners.

If you want to attack the Bitcoin network, there is a way. First let's explore a way that won’t work. Let's say you control 100 out of 1000 computers on the network. You get your computer to announce that you solved the puzzle, and you update the blockchain to report that someone just sent you 500 bitcoins! Then you have your 99 other computers agree that your fake puzzle solution is correct and your 100 computers add the 500 bitcoins to your account. The problem with this attempt is that 900 other computers on the network will see your puzzle entry is incorrect and not accept that transaction block. 900 other computers will accept a different transaction with a correct puzzle solution. The chain created by your 100 computers will not match the 900 other computers and the longest chain is considered the real Bitcoin and your 100 computers will be ejected from the network.

This still leaves a way for an attack. If you own more than 50% of the computers on the Bitcoin network, then you could possibly have your computers win most often and create the longer chain with your false entries or even by solving the puzzle first more often. It's very difficult and expensive to control 50% of Bitcoin and then if you did, it would be even more expensive to destroy your investment with an attack! This is why the bigger Bitcoin gets, the more resilient it becomes. If you are skeptical, that is OK, and natural, but remember, Bitcon has protected billions of dollars of value for over 10 years!

Books have been written on this topic and it takes a while to understand deeply, but the important point to understand is that instead of one person or one organization having the power to edit the record of who owns how much money, the entire network has to agree on any change to the record of which address owns how many bitcoins.

In other words, the US Central Bank can print a trillion new dollars and send them into the economy based on the personal decision of the Chairman of the Central Bank at any time. Bitcoin, however, can only print new tokens based on the rules of its software. In order to change those rules, almost all of the 10,000 network computers would have to agree to update the bitcoin issuance schedule.

Bitcoin’s Fixed Supply

Another important feature in Bitcoin’s design is that the amount of tokens it issues is fixed to never be more than 21 million. Unlike the central bank chairman who can print more money at any time, Bitcoin cannot print more than it's scheduled to unless everyone agrees to change those rules.

The rules of bitcoin show a declining number of bitcoin tokens awarded to the miners for processing transactions. Every four years, the number of the tokens awarded is cut in half. In about 100 years from now, there will be 21 million bitcoin tokens in circulation with no Bitcoins printed for mining transactions. At that point processors will only make money from transaction fees rather than from printing more tokens. Currently the issuance rate of new tokens printed by the Bitcoin system only adds less than 2% new tokens to the total supply every year. This makes Bitcoin similar if not more scarce than Gold which brings us to the Bitcoin valuation thesis.

Bitcoin’s Digital Gold Thesis

The valuation thesis for bitcoin rests on the idea that bitcoin is “digital gold” or Gold 2.0, an improved version of Gold. If you think about the properties that make a good store of value, you can look at those properties and see that bitcoin is better or can become better than gold as a store of value.

Portability - It's much easier to send $1 million dollars worth of bitcoin to the other side of the world than it is to send Gold.

Verifiability - Although gold’s unique color and weight can make it somewhat easy to verify that you are looking at real gold, bitcoin’s quantity and quality can be verified by looking at public blockchain data.

Divisibility - bitcoin can be divided down to 8 decimal places.

Scarcity - Gold won the competition as the best form of money over thousands of years due to its scarcity, but its supply still slightly increases 1-4% each year. (https://www.kitco.com/news/2022-06-20/Global-gold-supply-to-fall-after-2022-report.html) Meanwhile, bitcoin’s supply decreases by 50% every four years. The supply is currently inflating at 1.7% each year and will drop to .8% in 2024. This makes bitcoin less inflationary than gold.

Storability/security - If you have a significant gold investment, storage is difficult and is usually outsourced to storage operators you have to trust. Many people who invest in gold, own the ETF GLD, which doesn’t actually give you legal ownership of gold. “Regular shareholders have no rights of redemption and the gold is not required to be insured by the Trust, which is not liable for loss, damage, theft, nor fraud.” (https://www.forbes.com/sites/afontevecchia/2011/11/15/is-gld-really-as-good-as-gold/?sh=480a4d0d57c2).

Bitcoin storage has its own challenges with managing your keys, but it is more manageable for most people to safely store and travel with millions of dollars of value in Bitcoin than it is to store and secure gold.

Durability & age - Gold’s 2000+ years of use as money makes it clearly more durable and old. After 12 years, Bitcoin has proven to be more and more durable, but it can’t yet compete with the 2000+ year old record and brand trust of gold. (https://www.britishmuseum.org/collection/search?keyword=gold&object=currency&object=coin&dateTo=0&eraTo=ad&view=grid&sort=date__asc&page=1)

Censorship resistance - The problem with gold was the need for large players to store it in central well guarded locations. This liability is what helped governments capture a lot of the gold and then remove it from the monetary system. As discussed, Bitcoin looks much harder for even a large state attacker to manipulate.

Fungibility - If I lend you $10, when you pay me back, I don’t expect you to give me back the same exact $10 bill because money is fungible. When I drop my car off at the valet, I expect to get the same car back because it is not fungible. Gold is fungible because it is just a chemical element and one share of the ETF GLD is also fungible. Bitcoin is also fungible, but since all transactions are public on the blockchain, there is concern that the government could go after bitcoins that have been used illegally. This would make those bitcoins less valuable and therefore not fungible. There are laws regarding the fungibility of the US dollar so that people do not have to worry that they receive dollars that were previously used to commit crimes.

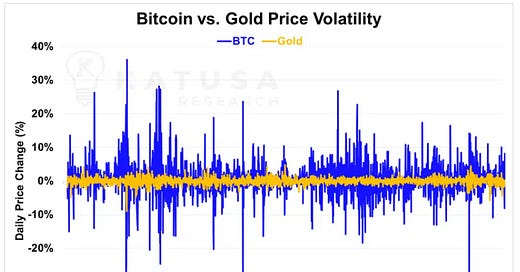

Stability - For something to hold value, it is also useful if its value is stable, and bitcoin has been famously volatile. There are those who argue that over a five year period bitcoin’s value is steadily going up, but many people may prefer a store of value that is more stable over a shorter time period and despite some volatility in gold, it is certainly less volatile than bitcoin.

(https://katusaresearch.com/bitcoin-vs-gold-part-1/)